On-Demand Content | Virtual Event

ABOUT SPAC OPPORTUNITY SUMMIT

As SPACS have moved from speculative to potentially overhyped to a smart mainstream investment approach, regulations, confidence, and adoption have shifted. The Third SPAC Opportunity Summit offers insights and perspectives from SPACs, Unicorns, Regulators, and Economic Leaders regarding the smartest ways to take advantage of this approach to bringing a company public.

Speaker Highlights

Top Reasons to Purchase

- Unicorns and Investors can Connect and Launch NEW DEALS.

- Momentum from the First Two SPAC Opportunity Summits makes this event the singular in-gathering for SPAC LEADERS to Interact and Learn Together.

- Gain the Insights Needed to tap into the SPAC Market NOW while the deals are flowing.

- ACQUIRE a clear understanding of the PROS & CONS of SPACs including legal implications and what the future holds.

- Leave with the TACTICS, RELATIONSHIPS, and KNOWLEDGE needed to take advantage of SPAC deals in smart ways.

Who Should Purchase

Industries:

- Consumer-Facing Brands

- Unicorns

- Start-Ups

- Investment Funds

Titles:

- Founder

- CEO

- CFO

- Investor

- Chief Analytics Officer

- Chief Strategy Officer

- VP/ SVP/ Data

- VP/SVP/Director Analytics

- VP/SVP/Director Strategy

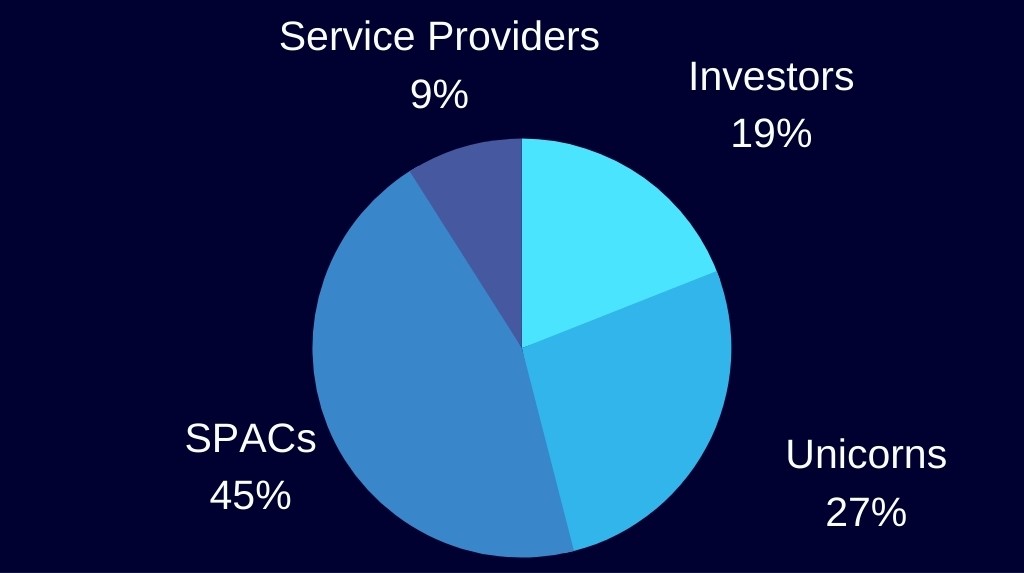

Who Attends the SPAC

Opportunity Summit?